The Invisible Privileges of Wall Street

Wall Street plays an important role in American capitalism. However, since the deregulation era of the 1980s, it has widened the wealth and income gap. Behaviors of Wall Street have led to actions that negatively impact 99% of the American population. Such behaviors are sometimes unconscious choices, though on multiple occasions are conscious choices based on greed. In this article, I describe how Wall Street has led to invisible privilege for a fraction of a percent of the American population, and the harm it poses to the growing inequality in American society. I describe this privilege by evaluating the following points:

- The disproportionate ownership of Wall Street.

- Influence over the American government.

- Inheritances that are harmful to American growth.

- Ability to make risky decisions driven by greed.

Disproportionate Wealth held by Wall Street

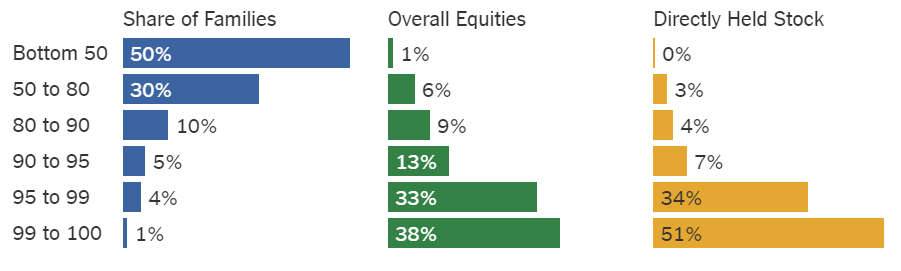

The top 5 percentile of Americans by wealth own 85% of all stocks. The top 1 percentile owns 51% of stocks. This means 85% of Wall Street is run by the top 5 percentile of Americans. During the pandemic, a market gain of approximately 16% led to a 4 trillion dollar growth in value. This means $3.4 trillion dollars was gained by only 10% of Americans and only $600 billion went to the remaining 90% [1].

Such disproportionate growth sheds a light on how Wall Street has led to privilege for a few. During the COVID-19 pandemic, we were in an illusion of a good economy. In reality, small businesses were shutting down, and low-wage workers were getting laid off. On the other hand, the top 10% saw their wealth skyrocket. The pandemic further widened the gap between the rich and the poor, especially because of the invisible privilege Wall Street caused for a fraction of Americans.

Families grouped by percentile of net worth [2]

Another privilege that comes with ownership of stocks is voting rights in business decisions. Since deregulation, the laws governing business decisions have been limited. Therefore, if shareholders decide it is profitable to layoff half of all employees in a business, they can do it. Such shareholder centrism is described in Prof. Karen Ho’s book - Liquidated: An Ethnography of Wall Street [3]. In chapter 3, she describes how shareholder centrism led to financial instruments such as junk bonds or leveraged buyouts of companies leading to mass layoffs counterproductive to the American dream.

Wall Street’s Influence Over American Government

The United States government was built over the principle of equal representation. Everyone has a say over policies. The motto of the United States is ‘E Pluribus Unum’ which translates ‘from many, one’. Government should be a place where everyone is represented, not just the top percentiles. The following scene from ‘The West Wing’ describes the objective of the American government well:

The objective of the government is known. However, due to unequal distribution of wealth, the US government has a skewed representation. Wall Street has a larger say over policies as compared to Main Street even though the prior represents only 10% of the American population.

The government is the orchestrator of American Capitalism. The pros and cons of capitalism are debatable, but its core principle is free markets. And to facilitate free markets, the government must make policies that benefit all. When capitalism was introduced in America, the benefits were given to only a few as described in Seth Rockman’s article - ‘The Unfree Origins of American Capitalism’ [4]. Even today, laws are passed that allow the top percentiles to retain their business positions, especially through lobbying.

One example is the Americans for Prosperity (AFP). The AFP was formed by Charles and David Koch, the founders of the Koch industries. Their company primarily focused on oil and gas pipelines. However, during the Clinton administration when VP Al Gore began building traction for the Energy Tax (also known as BTU tax), Koch brothers misused their power to oppose it.

When the tax was about to pass, the Koch brothers began lobbying the government through their think-tank - ‘The Cato Institute’. Ultimately, they decided to convince the voters in Oklahoma to call its representative and convince him to not pursue the tax. The strategy worked. Since then, no nationwide Energy Tax has been implemented.

David Koch at an Americans for Prosperity event. (Credits: Phelan M. Ebenhack/Associated Press)

A New York Times article from 1993 after BTU tax failed

Inheritances Harmful to American Growth

If principles of hard work and meritocracy are true, then the people working three jobs to barely provide for their families should be on top. However, this is not the case. We repeatedly see Americans from privileged backgrounds retaining their social status. Wealthy parents send their children to high schools like St. Paul in New Hampshire who later ended up going to ivy league colleges. As described in Mr. Shamus Khan’s book, these children are provided the social, economic, and educational resources that the majority of Americans do not get, enabling them to retain their status even though they live an easier lifestyle as compared to 99% of the country [5].

Another factor is the wealth inherited. Equity that is passed down generations leads to control with people who are not necessarily competent. However, they are handed power over a majority of the American population. A pop culture example of this is the HBO Max drama - Succession which revolves around a theme similar to the Murdoch family, where a media mogul who is dying must decide how to pass down the ownership of his company [6]. The mogul’s family is fighting over the control, and in many instances display incompetence and immorality.

HBO Max drama - “Succession” (left) and the Murdoch Family (right) [7]

A recent example is that of Sam Bankman-Fried, the CEO of FTX. Mr. Bankman-Fried was the son of two Stanford Law professors - Joseph Bankman and Barbara Fried. He lived a privileged lifestyle and had access to resources that most Americans didn’t. Though he might have worked hard, he had enough cushioning to take risks.

He led FTX as an incompetent CEO driven by greed. Inside FTX, there was no internal documentation or controls, and risky bets were made with crypto investors money. Nothing was hedged. When FTX filed for bankruptcy, the new CEO - John J Ray III, who led the Chapter 11 solvency said he never saw “such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here” [8].

John J Ray III testifying in front of the House Committee on FTX

Ability to Make Risky Bets

In 1999, President Bill Clinton repealed the Glass-Steagall Act of 1933. This act originally prevented banks from using commercial money for investment banking activities. There was a strict division between commercial banks and investment banks. However, after the repeal of the act, banks were allowed to use depositors money to make risky bets.

This act was one of many after the deregulation that favored the top 10 percentile over the rest of the nation. Wealth never trickled down. Instead, disasters trickled. Wall Street got bailed out, but Main Street struggled with debt and homelessness.

After the financial crisis, Ben S. Bernanke, the federal reserve's chairman in 2009, pumped money into American society. Interest rates went to zero percent. The assumption was that the money given to banks will trickle down. However, it led to riskier investments. The frustration was felt by both sides of the political spectrum and we saw the emergence of the Tea Party as well as the radical left.

Takeaway

Representation in Wall Street is skewed. It is owned by a fraction of the American population leading to not only wealth, but power over major decisions. The privilege exercised by Wall Street is counterproductive to the American dream. It is necessary to study and execute policies that keep this privilege in check in order to comply with the pursuit of happiness for all.